Cash Reserves vs. Investment: Where Should Your Extra Cash Go?

- AMS Team

- Jun 25, 2025

- 4 min read

Choosing Between Cash Reserves vs Investment for Better Financial Growth

You have extra cash. Should you keep it safe in a savings account or invest it for the future?

This depends on your goals, how much risk you can handle, and when you might need the money.

In this blog on Cash Reserves vs Investment, we will help you decide how to split your extra funds between cash reserves and investments.

You will learn how each choice affects your financial health and what steps to take to make the most of your money.

What Are Cash Reserves and Why Do They Matter?

Cash reserves are money you keep ready for emergencies or short-term needs.

They are liquid funds. You can access them quickly without losing value.

Common places to keep cash reserves in the UK include:

Easy-access savings accounts

Money market funds

Premium bonds

Treasury bills (T-Bills)

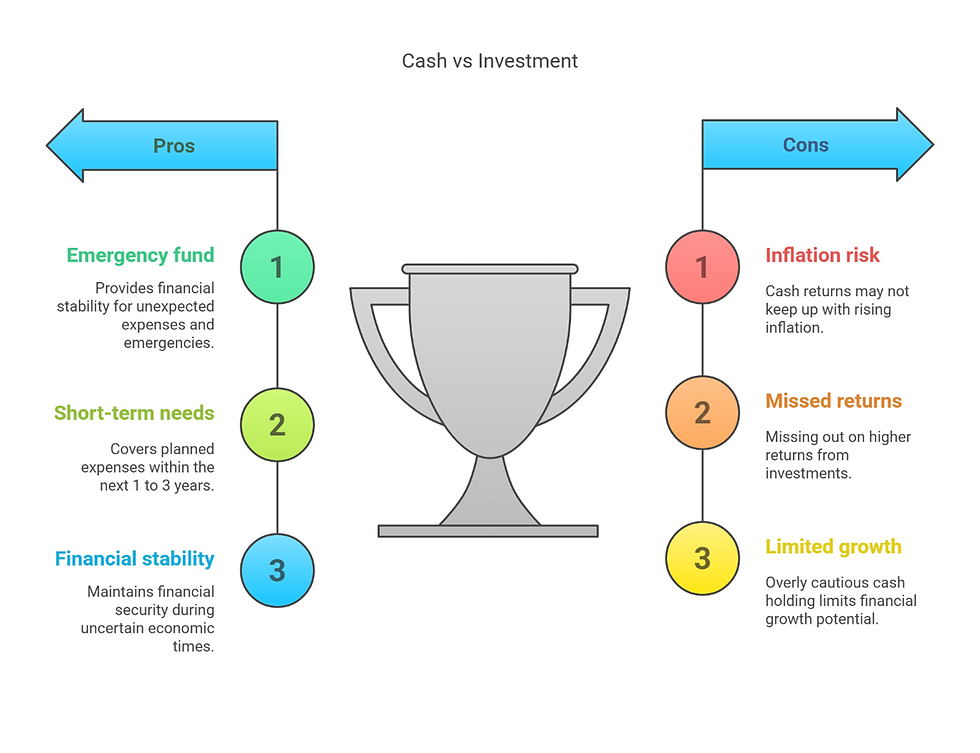

The main reasons to have cash reserves are:

To cover emergencies, like unexpected bills or urgent repairs.

To pay for planned expenses within the next 1 to 3 years.

To maintain financial stability during uncertain times.

Experts often recommend keeping enough cash to cover 3 to 6 months of your expenses.

Having a solid cash reserve is a crucial step toward financial security and peace of mind.

When Holding Too Much Cash Becomes a Problem?

Holding cash feels safe. But too much cash can hurt your finances.

Interest rates on UK savings accounts have recently peaked around 4.5% but are expected to fall during 2025.

Inflation in the UK has been around 3% to 4% recently, which means cash returns may not keep up with rising prices.

If your cash grows slower than inflation, you lose buying power.

Keeping too much cash means missing out on higher returns elsewhere.

For example, over the past 20 years, the FTSE 100 index returned about 6.3% annually including dividends, which after subtracting inflation gives a real return of roughly 3.5% per year.

Being overly cautious with cash might limit your financial growth and reduce your wealth-building potential.

Balancing cash safety with investment growth is key to avoiding these problems.

What Makes Investing a Powerful Long-Term Tool?

Investing offers higher potential returns than cash over time.

It is designed to beat inflation, helping your money grow in real terms.

Investing suits long-term goals like retirement, education, or building wealth.

Historical UK data shows the FTSE 100 has delivered average annual returns of about 6.3% including dividends over the past 20 years.

After adjusting for inflation, that’s a real return of around 3.5% per year.

Investing requires patience. Markets fluctuate, but staying invested usually pays off in the long run.

Using investments wisely can help you grow your money and meet your future financial needs.

Cash vs Investment – How to Decide?

Deciding between cash and investment depends on four key questions:

Do you have an emergency fund?

Make sure you have cash set aside for unexpected expenses before investing extra money.

What is your time horizon?

If you need the money within three years, keep it in cash or other liquid assets.

For money you won’t need for five years or more, investing is usually better.

What is your risk tolerance?

If you prefer safety and less fluctuation, keep more in cash.

If you can handle ups and downs, investing can offer better growth.

Are you ready for market ups and downs?

Investments can go down as well as up. Staying calm and focused on the long term is important.

Answering these questions helps you find the right balance between security and growth.

Strategic Ways to Use Both Cash and Investments

Using both cash and investments wisely can help you meet different financial needs.

Short-Term Strategy (0–3 years):

Keep money in easy-access savings accounts or fixed-term savings.

This covers planned expenses and emergencies without risking loss.

Cash gives you quick access and peace of mind.

Medium-Term Strategy (3–5 years):

Use a mix of cash and low-risk investments like bonds or cautious funds.

This balances growth potential with safety.

It helps your money work harder while keeping some stability.

Long-Term Strategy (5+ years):

Focus on diversified investments such as stocks, index funds, or pensions.

These offer better growth chances over time.

Long-term investing helps beat inflation and build wealth.

Tax-efficient accounts like ISAs can boost your returns by sheltering interest, dividends, and capital gains from tax.

A balanced approach lets you protect your short-term needs while aiming for long-term growth.

Key Risks and How to Mitigate Them

Both cash and investments come with risks you should understand.

For Cash:

Inflation risk reduces the buying power of your money over time.

Interest rates can change, affecting how much your savings earn.

For Investments:

Market volatility means prices can rise and fall unpredictably.

Timing risk involves buying or selling at the wrong moment, which can hurt returns.

To manage these risks:

Diversify your investments across different assets and sectors.

Rebalance your portfolio regularly to keep your risk level in check.

Avoid making emotional decisions during market swings.

Keep enough cash reserves to cover emergencies, reducing the need to sell investments at a loss.

Understanding and managing these risks helps you protect your money and reach your financial goals.

Conclusion: Don’t Pick One, Balance Both Wisely!

Cash and investments serve different but equally important roles.

Use cash reserves to secure your financial base and handle short-term needs.

Then, allocate extra funds toward investments to grow your wealth over time.

A balanced strategy gives you peace of mind and the chance to build a stronger financial future.

By combining security with growth, you make your money work smarter for you.

Need help deciding how to split your savings and investments?

AMS can help you build a personalized financial strategy that aligns with your goals, risk profile, and timeline.

Contact AMS today to start planning smarter!

Comments