Should You Register for VAT? A Straightforward Guide for Tradespeople

- AMS Team

- Jul 23, 2025

- 5 min read

Why VAT Matters for Tradespeople?

VAT is a legal requirement for many self-employed professionals in the UK.

As your business grows, your turnover might reach a level where VAT registration becomes mandatory.

Understanding VAT helps you avoid penalties and manage your finances better.

This blog explains what VAT is, when you need to register, and whether early registration could benefit your business.

Continue reading to know more!

What Is VAT and Who Needs to Pay It?

VAT stands for Value Added Tax. It applies to most goods and services sold by registered businesses in the UK.

You collect VAT from your customers and pay it to HMRC.

There are three main VAT rates in the UK:

Standard rate (20%): Most goods and services

Reduced rate (5%): Items like energy and children’s car seats

Zero rate (0%): Most food, books, and children’s clothing

Some services, such as insurance and healthcare, are exempt from VAT.

Understanding which rate applies to your work is essential for compliance and accurate invoicing.

The VAT Threshold in 2024/25

The VAT registration threshold increased to £90,000 from April 2024.

This threshold is based on your total taxable turnover over any rolling 12-month period not the calendar year or tax year.

Once your turnover goes above £90,000, you must register for VAT by law.

This rule applies to sole traders, partnerships, and limited companies.

Keeping track of your turnover ensures you stay compliant and avoid penalties.

How to Check If You’re Near the Threshold?

Calculate your taxable turnover by adding up all non-exempt sales over the past 12 months.

Use bookkeeping software or work with an accountant to track your income in real time.

If your turnover is close to £90,000, start preparing for the administrative and financial changes that VAT registration brings.

Regular monitoring helps you avoid missing the point when registration becomes mandatory.

How to Register for VAT?

You can usually register for VAT online through the HMRC website.

To register, you need to create a Government Gateway account if you don’t have one already.

You will need to provide:

Your National Insurance number (for sole traders or partnerships) or company registration number (for limited companies)

Your Unique Taxpayer Reference (UTR)

Business bank account details

Details of your annual turnover and an estimate of taxable turnover for the next 12 months

Identity documents, such as a passport or driving licence, if registering as an individual

If you cannot register online, you can apply by post using form VAT1 in special cases.

After registration, HMRC will send you a VAT registration certificate with your VAT number and the effective date of registration.

You must start charging VAT and submitting digital VAT returns from that date.

Appointing an accountant or agent to handle VAT submissions is an option if you prefer.

This process ensures you meet legal requirements and can reclaim VAT where applicable.

Understanding VAT Accounting Schemes

Different VAT accounting schemes can help you manage payments and paperwork.

Here are the main options for tradespeople:

Flat Rate Scheme (for turnover under £150,000):

Pay a fixed percentage of your gross turnover to HMRC.

You cannot reclaim VAT on most purchases.

This scheme simplifies calculations and reduces paperwork.

Cash Accounting Scheme (for turnover under £1.35 million):

Pay VAT only when you receive payment from customers.

This helps with cash flow, especially if clients pay late.

Annual Accounting Scheme (for turnover under £1.35 million):

Submit one VAT return per year instead of quarterly.

Make advance payments throughout the year.

Choosing the right scheme can make VAT management easier and support your business’s cash flow.

Benefits of Being VAT Registered (Even Voluntarily)

Registering for VAT offers several advantages, even if your turnover is below the threshold.

You can reclaim VAT on tools, equipment, and materials used in your business.

Being VAT registered can make your business appear larger and more professional.

It may help you win bigger contracts, especially with other VAT-registered businesses.

You can claim back historic VAT on goods still in use, up to four years before registration.

VAT registration streamlines your tax processes and helps you plan for long-term growth.

These benefits can improve your business’s financial position and reputation.

Drawbacks of VAT Registration

Registering for VAT comes with some challenges you should consider.

You must add 20% VAT to your invoices, which can increase your prices.

This may make your services less competitive, especially if many clients cannot reclaim VAT.

VAT registration brings extra administration, including quarterly VAT returns and strict invoicing rules.

You must keep accurate records of all sales, purchases, and VAT charged or reclaimed.

Mistakes or delays can lead to HMRC penalties and interest charges.

Managing VAT requires time and attention, which may increase your accounting costs.

Weighing these drawbacks against the benefits helps you decide if VAT registration suits your business.

What Happens If You Ignore VAT Obligations?

Failing to register for VAT when required can lead to serious consequences.

You may face penalties for late registration.

HMRC can demand backdated VAT payments, including interest.

Ignoring VAT rules increases the risk of audits and further fines.

Regularly monitoring your turnover and acting promptly helps you avoid these issues.

Staying compliant protects your business’s reputation and finances.

VAT Invoicing Requirements for Tradespeople

When you are VAT registered, your invoices must include specific information to comply with HMRC rules.

Your invoice should have:

A unique invoice number

Your business name and address

Your VAT registration number

The client’s name and address

A clear description of each item or service supplied

The unit price for each item

The VAT rate applied (standard, reduced, or zero)

The amount of VAT charged for each item

Including these details ensures your invoices are valid for VAT purposes and helps your clients reclaim VAT if they are registered.

Accurate invoicing reduces errors and supports smooth VAT reporting.

Should You Register Voluntarily?

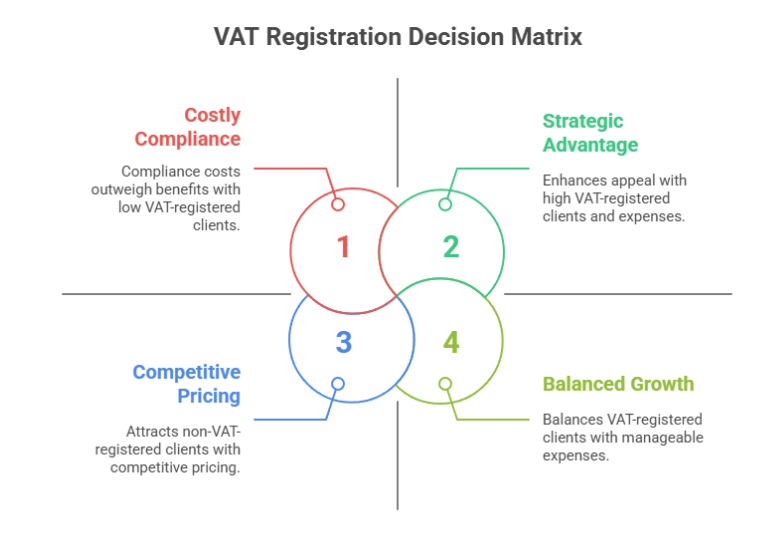

You can choose to register for VAT even if your taxable turnover is below the £90,000 threshold. Voluntary registration may benefit your business in specific situations.

Consider voluntary registration if:

You supply other VAT-registered businesses, as they can reclaim the VAT you charge, making your services more attractive.

You invest in tools or equipment and want to reclaim VAT on these purchases.

You want to project a more professional image or enhance your business credibility.

Avoid voluntary registration if:

Most of your clients are individuals or businesses not registered for VAT, as they cannot reclaim VAT and may see your prices as less competitive.

You are concerned about the extra administrative work or the impact of VAT on your pricing and profit margins.

Voluntary VAT registration is a strategic decision that depends on your client base, business expenses, and growth plans.

Stay Compliant, Stay Competitive!

VAT registration is a key compliance step for UK tradespeople once your turnover crosses the threshold.

If your business is smaller or growing, voluntary registration can be a smart strategic move but it’s not the right choice for everyone.

Weigh the pros and cons based on your client base, pricing, and cash flow. Keep accurate records, monitor income monthly, and use reliable bookkeeping tools to stay on top of your obligations.

And when in doubt, get expert help!

AMS Admin Services can support you with VAT registration, quarterly returns, and digital recordkeeping so you can focus on running your trade business, not chasing paperwork.

Need help registering or managing VAT?

Reach out to AMS for trusted, no-fuss support!

Comments