Tax Avoidance – Don’t Get Caught Out!

- AMS Team

- Mar 27, 2025

- 10 min read

What Is Tax Avoidance (and Why It Matters to You)?

Tax avoidance means using legal loopholes to reduce your tax bill. While it may follow the letter of the law, it often breaks its intended spirit.

In the 2022–23 tax year, HMRC estimated the total tax gap—the difference between the tax that should be paid and what is collected—to be £39.8 billion, representing 4.8% of total theoretical tax liabilities. Within this, tax avoidance specifically accounted for £1.8 billion. This highlights the significant impact of tax avoidance on public finances and underscores HMRC's intensified efforts to address this issue.

It’s not the same as tax evasion, which is illegal. But it can still get you into serious trouble with HMRC.

So, Why Should You Care?

Because HMRC is cracking down—and fast.

Many people are being caught up in tax avoidance schemes without realising it. This is especially common among:

Contractors

Agency workers

People working through umbrella companies

These schemes are often disguised as ways to boost your take-home pay. But if HMRC believes you’ve underpaid tax, you could face:

Penalties

Interest

Or worse

What this blog will help you do:

Understand what tax avoidance really is

Spot the red flags and protect yourself

Know what to do if you’re already involved

Learn how to report suspicious schemes

Find the right help if HMRC gets in touch

Whether you're working for yourself, running a business, or reviewing your payslip—this guide will help you stay informed and compliant.

Tax Avoidance vs. Tax Evasion – What’s the Difference?

There’s often confusion between tax avoidance and tax evasion—but the difference matters.

Tax Avoidance:

This is when someone reduces their tax bill by exploiting gaps in the law. It's legal, but that doesn't mean it's safe.

Many avoidance schemes are:

Overly complex or artificial

Not fully disclosed or misrepresented

Created only to secure a tax benefit Parliament never intended

Even though tax avoidance stays within the law, HMRC can still challenge it. If they do, you could face financial penalties—or worse.

Tax Evasion:

Tax evasion is illegal. It includes:

Hiding income

Using offshore accounts to avoid tax

Submitting false returns

Evasion is a criminal offence. It can lead to prosecution, heavy fines, or prison.

Is Tax Avoidance Legal?

Yes—but legality doesn't equal safety.

HMRC often treats aggressive avoidance as an attempt to cheat the system. You could face:

Civil penalties

Criminal charges

Long-term financial consequences

If your pay structure doesn’t make sense or seems unusual, seek professional advice.

Understanding the Tax Gap

Each year, HMRC estimates how much tax should be collected—and how much actually is. The difference is called the tax gap.

How Big Is the UK Tax Gap?

In the 2022–23 tax year, the tax gap stood at a massive £39.8 billion.

Cause | Amount | % of Total |

Mistakes (errors & carelessness) | £17.8 billion | 45% |

Tax evasion & criminal activity | £11.2 billion | 25% |

Legal disputes & avoidance | £5.7 billion | 14% |

Non-payment (bad debts etc.) | £5.2 billion | 13% |

What Does This Tells Us?

Tax avoidance makes up only a small part of the gap—around 4.5%. Most of the gap comes from:

Basic mistakes

Careless reporting

Deliberate evasion

Aggressive avoidance grabs headlines. But it's human error that leads to the biggest losses.

Why It Matters?

Understanding the tax gap helps HMRC and the public focus on real issues. That’s why efforts go beyond enforcement. HMRC also works to:

Educate taxpayers

Reduce common filing errors

Strengthen compliance systems

How to Spot a Tax Avoidance Scheme?

Tax avoidance schemes often look like smart ways to boost your take-home pay. But if you know what to look for, the warning signs are easier to spot.

Red Flags to Watch Out For:

You might be in a scheme if:

Your take-home pay seems unusually high

Part of your pay is labelled as a loan, advance, or annuity

Payments come from multiple or offshore accounts

You’re told the scheme is "HMRC approved" — it’s not. HMRC never endorses schemes

These setups often hide taxable income behind complicated payment structures. But you’re still responsible if HMRC challenges it.

Common Types of Schemes:

These schemes often target:

Contractors

Freelancers

Agency workers

Examples include:

Disguised Remuneration Schemes

You're paid through loans or similar tools that aren’t meant to be repaid.

Umbrella Payroll Schemes

Your salary is split into a small, taxed portion and a larger untaxed one, often mislabelled.

Contractor/Agency Worker Schemes

These use unusual contracts or third-party routing to obscure how you're really paid.

If something about your pay seems unclear or overly complex, don’t ignore it. Check with an independent adviser before continuing.

Your Payslip & Pay Structure – What to Look Out For?

Your payslip can reveal a lot—if you know what to check. Many people end up in tax avoidance schemes simply because they didn’t notice how their income was structured.

What to Check?

Review your payslip and payment details carefully. Ask yourself:

Does your net pay match what’s being deposited into your bank?

Is every part of your pay clearly labelled as taxable income?

Is any part described as a loan, advance, or capital payment?

Are you being paid from unfamiliar or multiple sources?

If anything seems off or hard to understand, investigate it further.

Use HMRC’s Risk Checker:

HMRC offers a free risk checker to help you spot tax avoidance. It only takes a few minutes—and could save you from future problems.

Tip: Run this check regularly, especially if you work through an umbrella company. Payment setups can change over time.

Need Help Understanding Your Payslip?

Payslips can be confusing. HMRC’s online guide explains:

What each section means

How deductions are shown

What may signal a potential issue

Understanding your payslip is a key step in protecting yourself.

Umbrella Companies – Know the Risks

If you’re a contractor or agency worker, you’ve probably come across umbrella companies. Many operate legally and handle tax correctly. But others use risky arrangements that could leave you in trouble with HMRC.

How Umbrella Companies Work?

An umbrella company employs you on behalf of a recruitment agency or client. They process your payroll, deduct tax and National Insurance, and then pay you your salary.

When done properly, this setup is compliant and convenient.

When Things Go Wrong?

Some umbrella companies run tax avoidance schemes by misrepresenting how they pay you. These setups might:

Split your pay into a small, taxed salary and a larger, untaxed amount

Label the untaxed portion as a loan, grant, or investment

Route payments through offshore accounts or third-party companies

These tactics may look legitimate—but HMRC can still hold you responsible for any unpaid tax.

Warning Signs to Watch For:

Watch out if:

You’re promised 90–95% take-home pay

Part of your income isn’t taxed through PAYE

Payments come from unfamiliar or overseas sources

Payslips or contracts are unclear or overly complex

If anything seems off, don’t assume it’s safe; check with an independent adviser.

Real-Life Case Studies – When Tax Avoidance Hits Home

Tax avoidance schemes don’t just affect big businesses. Many ordinary people get caught up without realising the risks—until HMRC contacts them.

Here are two real stories that show how easily it can happen.

Tanya, a single parent and full-time nurse, signed up with a payroll service that promised to increase her take-home pay. It sounded like a smart move—until HMRC got in touch. She found out she’d been paid through a tax avoidance scheme. Despite paying fees to the promoter, she now faced a large tax bill and penalties.

Lesson: If you don’t understand how you’re being paid, ask. Don’t assume it's safe because others use it.

Duncan worked as an IT project manager and used an umbrella company to manage his pay. It seemed straightforward. But behind the scenes, the company was using an offshore scheme. He only found out when HMRC began an investigation. Now he owes thousands in backdated tax—on income he didn’t realise was part of a scheme.

Reminder: If something about your pay feels unclear, don’t ignore it. Double-check before it’s too late.

These stories are common. Taking a closer look at your income now can save you serious stress later.

What to Do If You're in a Tax Avoidance Scheme?

If you think you’re in a tax avoidance scheme, don’t delay. Acting quickly can help you avoid bigger problems.

Here’s What You Should Do Right Away:

1. Contact HMRC:

Tell them about your situation. They’ll explain your options and help you start resolving your tax position.

They may also offer:

Guidance on next steps

A payment plan if you can’t pay everything at once

HMRC Helpline Numbers:UK: 0800 788 887Outside UK: +44 (0)203 0800 871

2. Review Your Tax Records:

Check your:

Payslips

Contracts

Tax returns

Look for anything unusual in how your income was reported. Understanding the details will help you and any adviser make the right decisions.

3. Seek Expert Advice:

Speak to a qualified accountant or tax adviser. If legal action is possible, consult a solicitor with tax experience.

Tip: Don’t rely on advice from the promoter or anyone involved in the scheme.

Reporting a Tax Avoidance Scheme

If you’ve come across a tax avoidance scheme—or think you’re part of one—reporting it can help protect you and others. You can do it anonymously.

How to Report a Scheme?

You can report to HMRC using:

HMRC’s helpline: 0800 788 887

Use the code ‘TAC’ when reporting. This helps HMRC track the scheme more effectively.

Why Reporting Matters?

Protect yourself – Early reporting may reduce penalties or interest

Protect others – Helps stop the scheme from spreading

Support enforcement – Provides HMRC with leads to shut down promoters

Even if you’re not directly involved, your information could help someone else avoid serious consequences.

Legal & Financial Consequences of Tax Avoidance

Getting involved in a tax avoidance scheme can lead to more than a surprise tax bill. You could face serious financial and legal consequences.

HMRC Penalty Levels:

If HMRC finds you’ve underpaid tax, the penalty depends on your level of responsibility:

Situation | Possible Penalty |

You took reasonable care | No penalty |

Mistake due to carelessness | Up to 30% of tax owed |

Deliberate underpayment | Up to 70% of tax owed |

Deliberate & concealed scheme | Up to 100% of tax owed |

Penalties may increase if you ignored warnings or failed to disclose the scheme.

Could You Face Criminal Charges?

Yes—especially in cases involving fraud or deception. HMRC may take criminal action, including:

A civil investigation under Code of Practice 9 (COP9)

Prosecution of scheme promoters

Criminal charges for cheating the public revenue, which carries a maximum sentence of life imprisonment

While not all cases go this far, the risk is real—particularly for those promoting or knowingly using avoidance schemes.

HMRC Investigations – What to Expect?

If HMRC suspects you’re involved in a tax avoidance scheme, they’ll carry out a structured investigation. Knowing what to expect can help you stay calm and respond appropriately.

Step 1: Notification Letter

You’ll receive a formal letter explaining that your tax records are under review. HMRC may ask for documents or a breakdown of how you've been paid.

Tip: Respond promptly. Delays can make things worse.

Step 2: Compliance Check

HMRC will examine your:

Tax returns

Payslips and contracts

Financial history

They’ll assess whether you underpaid tax—and if it was due to an error, carelessness, or deliberate avoidance. They may also look for links to known scheme promoters.

Step 3: Outcome

Depending on their findings, HMRC may:

Demand backdated tax

Add interest and penalties

Begin legal proceedings in serious cases

How you cooperate during the process affects the outcome.

What About Scheme Promoters?

Promoters face more serious consequences. HMRC may:

Issue a Stop Notice to prevent further promotion

Apply civil penalties

Launch criminal investigations if fraud is suspected

Disclosure Obligations & DOTAS

Some tax avoidance schemes must be reported to HMRC under the Disclosure of Tax Avoidance Schemes (DOTAS) rules.

What is DOTAS?

DOTAS stands for Disclosure of Tax Avoidance Schemes. It’s a legal framework requiring certain schemes to be reported to HMRC, primarily by the people who promote or design them.

If You're a Promoter:

You must:

Disclose the scheme to HMRC

Get a Scheme Reference Number (SRN)

Share the SRN with anyone using the scheme

Failure to disclose can lead to significant penalties.

If You're a Participant:

If you’re given an SRN:

You must include it on your tax return

You're responsible for ensuring it’s reported correctly

Note: An SRN doesn’t mean HMRC approves the scheme. It only means they’re aware of it and may investigate further.

If you’re unsure whether DOTAS applies, speak to a qualified adviser before filing.

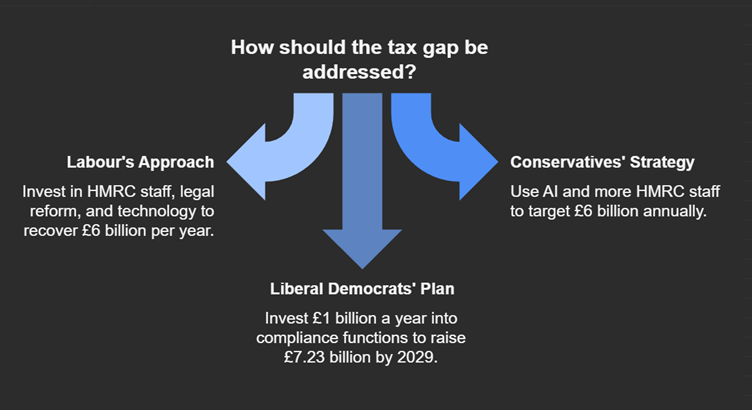

Political Response to Tax Avoidance & the Tax Gap

Tax avoidance and the wider tax gap are major political issues—especially during election campaigns. With billions in lost revenue, parties are under pressure to act.

What the Main Parties Are Promising?

Recent manifesto pledges include:

Labour: Recover £6 billion per year by investing in HMRC staff, legal reform, and technology.

Conservatives: Target £6 billion annually using AI, more HMRC staff, and tighter rules on tax advice.

Liberal Democrats: Invest £1 billion a year into compliance functions to raise £7.23 billion by 2029.

Reality Check: Where the Focus Should Be?

While these figures are ambitious, tax avoidance only makes up around 4.5% of the total tax gap. The biggest share—about 45%—comes from:

Errors

Carelessness

Misreporting

So, while targeting avoidance helps, improving taxpayer support, education, and system clarity could have a greater long-term impact.

How to Stay Compliant?

Avoiding tax avoidance is about being informed, organised, and cautious with any offer that affects your income.

Do’s: Good Habits That Keep You Safe:

Keep accurate records – Save payslips, contracts, and tax returns

Review your payslips and contracts regularly – Make sure all income is taxed properly

Use legitimate tax-saving tools – Such as ISAs, pensions, or approved business reliefs

Small checks now can prevent major problems later.

Don’ts: What to Avoid:

- Don’t trust schemes that claim to be “HMRC approved” – HMRC doesn’t approve tax schemes

- Avoid offshore or complex setups promising unusually high take-home pay

- Don’t rely solely on advice from scheme promoters – Always get an independent opinion

Smart & Legal Tax Planning

There are safe ways to reduce your tax bill:

Capital allowances – For equipment or property investments

R&D tax credits – For businesses focused on innovation

Salary sacrifice – For pensions, childcare, or bikes

These are designed to work within UK tax rules—and won’t put you at risk.

Conclusion: Stay Informed, Stay Compliant!

Tax avoidance isn’t just a corporate issue—it’s ordinary people who often face the harshest consequences. Contractors, freelancers, and agency workers are especially vulnerable to being drawn into risky arrangements.

Key Takeaways:

HMRC is stepping up enforcement—and individuals are being held accountable, even if misled.

Review your pay structure regularly. If something doesn’t make sense, don’t ignore it—ask questions.

Act quickly if you suspect an issue. Getting advice early can reduce stress, penalties, and financial damage.

Reporting suspicious schemes helps protect both you and others from being caught out.

Spread the Word:

If you know someone working through an umbrella company or agency, share this guide. It could save them from unexpected tax bills, financial pressure, or long-term legal issues.

Help Shape the Future:

HMRC is working to improve how tax avoidance guidance is delivered. Your feedback matters. If something in this guide helped or left you with questions—let them know.

Comments